Dec 25, 2023:

Short Term Outlook – Halt with Bearish tones…

Dec 25, 2023: In the week ending on Dec 23rd 2023, Nifty 50 reached a new high of 21593 before correcting to a weekly low of 20976 and then closing above 21000. This correction was much needed one as most of other Market Indices including Nifty and Bank Nifty were overstretched, but it also caused a halt to the upward momentum we saw during previous weeks.

Time to look at Micro Structure…

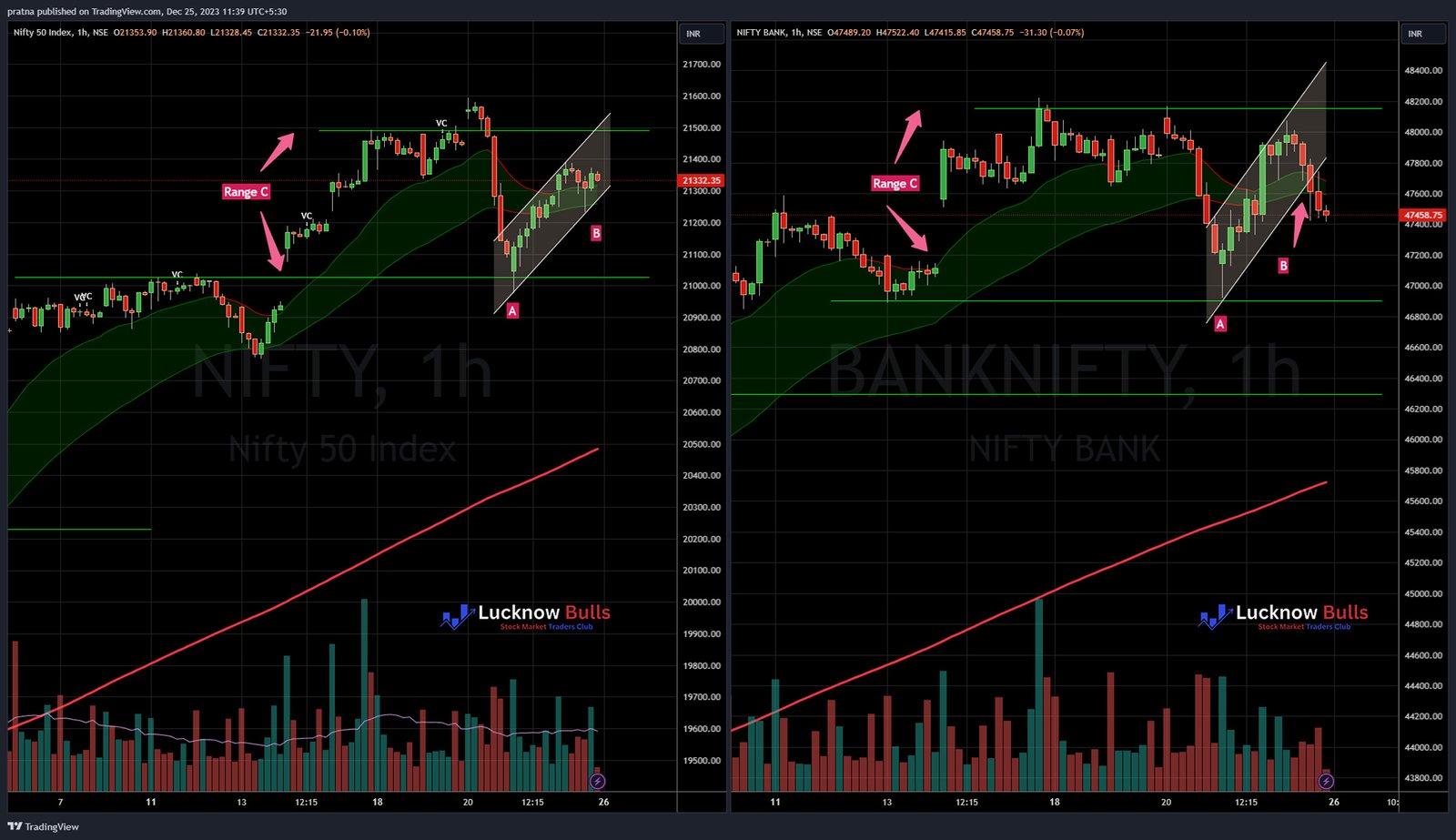

Previous weeks volatility, has forced us to look into micro structure of the two main Indices while the larger structure remains intact. Lets look at hourly charts for both the Indices, as pasted above. We can clearly see that for mid term purpose, markets are within Range “C” and that signifies the continuation of up trend. However a halt from correction from last week has brought them to a level of marker “A”, which is right at the bottom of the range “C”. Though lower end of range “C” was tested, it has resulted in a loss of momentum and very important for the indices to remain within the while channel. If we observe Bank Nifty then it has broken down from the channel and it can very well test the lower side of Range “C” again unless it pops back in. All in all its a halt and a much needed breather going into year end holidays.