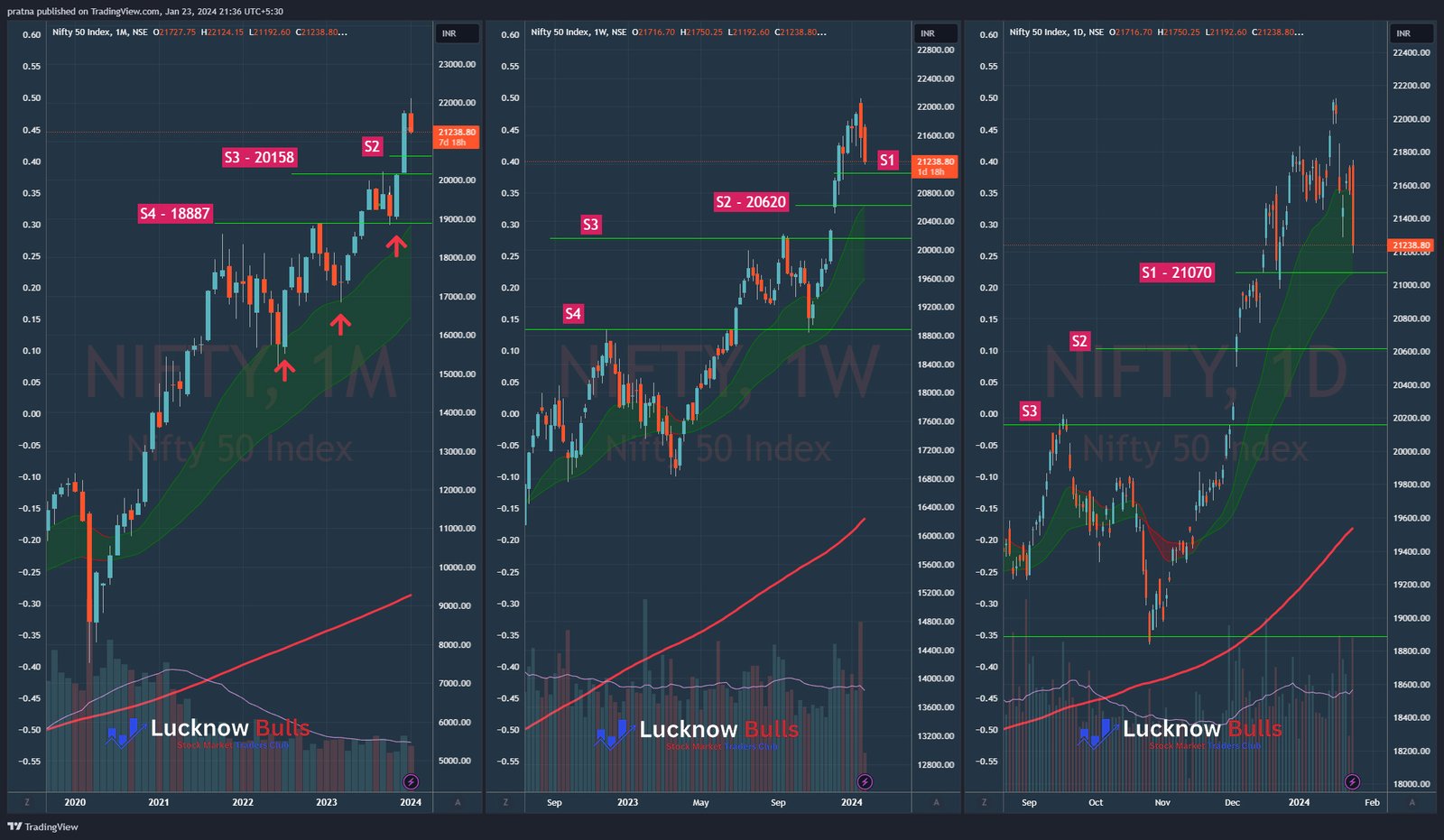

Jan 23, 2024: On a very short-term basis, there is a good chance that Nifty will take a halt and a breather while consolidating between a broader range of S1 21070 and R1 at 21495. The current close is at 21238. On smaller timeframes, it seems oversold and a gap-up opening is not ruled out for tomorrow. Alternatively, it can also touch S1 and rebound from there.

Let’s check if the larger trend is intact or not.

On both Monthly and Weekly timeframes, the Uptrend structure is intact considering that today’s Close is far above the upper band of the MA Sweep. However, kindly note that Monthly is still a running month hence we should take caution of the current correction reaching the Weekly timeframe. It means that now any reversal has to get confirmation on the Weekly frame, even though the current week too is a running candle.

The first support level S1 – 21070 comes from Daily Timeframe as there is scope for NIfty to touch the lower band of the MA sweep.

On the weekly timeframe, there is scope till S2 – 20620 or to the upper band of the MA sweep, if and when it reaches that upper level.

For this week, any day trade reversals between S1 & S2 can only be assessed at smaller time frames but as I said earlier, for positional, confirmation needs to come on a Weekly timeframe.

What does it mean for our existing positions?

Considering there is still quite a scope for correction remaining, I would suggest not taking fresh positions unless we get a pause or reversal confirmation at the Weekly level. The majority of good large caps and good mid-caps have also a very similar structure to Nifty Monthly & Weekly and similar levels can be derived for them as well.