Jan 05, 2023: As the New Year arrived, exuberance among investors for mid and small-cap stocks continues, with many of us still waiting for some pause to get into reasonable valuations. Many of us would remember that Kotak in Sept of 2023 had put out a note that they were no longer standing behind their model mid-cap portfolio due to stretch valuations. Yet, Brokerages continue to dole out mid-caps and small-cap picks daily to whet the appetite of investors even when their analysts on national media try to sound a bit cautious as face-saving measures, in case something goes wrong since current valuations within mid and small-caps have low margins of safety.

So what am I telling my investors about the current situation as the majority is feeling lost out? My advice to them is to look for “Technical Value Investing” a term that I have coined for my proprietary system. What does that mean? Let me explain through charts, but first look at the following data:

| Index | Jan’2021 Close | YoY | Jan’2022 Close | YoY | Jan’2023 Close | YoY | Jan’2024 04/01* | YoY |

|---|---|---|---|---|---|---|---|---|

| Small Cap 100 | 7176 | 15% | 11116 | 55% | 9501 | -15% | 15339 | 61% |

| Mid Cap 100 | 20909 | 16% | 30273 | 45% | 30676 | 1% | 47309 | 54% |

| Nifty 50 | 13634 | 14% | 17339 | 27% | 17662 | 2% | 21658 | 23% |

What can we conclude from the above? We can observe that the Nifty 50, which represents Large Caps, has not matched the gains of Small and Mid caps. And that’s quite evident. However, in technical terms, we can state that Large Caps, except for a few areas, have now consolidated for over 2 years or more since Jan 2021 and that is where the new Multibaggers are lurking. The Blue Chips have gone through the consolidation or accumulation phase and the market will eventually ride on these stocks once the exuberance dies out.

Let’s look at stocks that are on my radar and can commence their journey now:

- Voltas is my favorite here as has the best structure

Voltas tested the primary support of pre-Covid highs and the first target for the stock would be to reach Oct 2021 highs

2. Pfizer – the move is just starting out

Pfizer has just come out of the base structure and has a lot of potential to reach July 2021 highs

3. Divis Lab – just starting out

Divis Lab is another of my favorite stocks as the move has just started and should test the highs of August 2021

4. Aarti Ind: The Chemical sector will get rerated soon and this will be a winner there

Aarti Ind again has just come out of the long basing structure and should continue the journey upwards to meet October 2021 highs

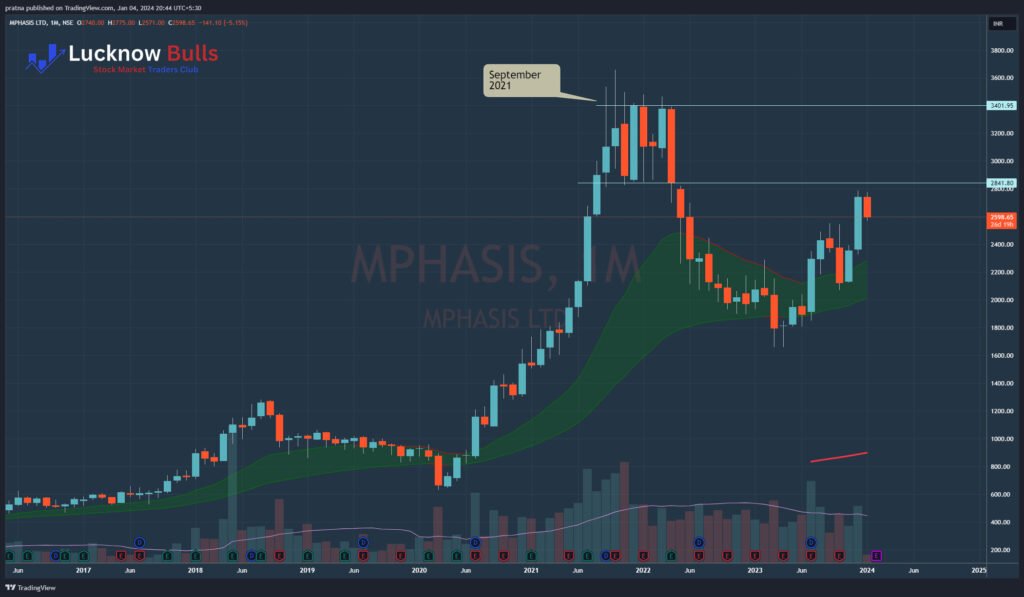

5. Mphasis – 1st IT Services Stock in the list which shall do pretty well

IT stocks are all consolidating and I feel Mphasis has the best structure there within large IT stocks

6. Coforge – A good example for the rest of the stocks here in this list on the potential journey and way forward

Check how it completed its basing and then completed the 1st target of reaching October 2021, then broke out from their last month, and now tested the support of Oct 2021. Coforge should do pretty well and is in the second phase of the journey

7. INFY & TCS – both are at different places but the potential path is the same, INFY is lagging behind TCS at this time

INFY,

and TCS which is yet to reach October 2021 highs

8. A Few Bluechips that are ranging but once they break-out, it will easily be a 50% move in quick time

Asian Paints:

Hindustan Lever:

Kotab Bank:

and lastly,

HDFC Bank:

One might question why allocate funds to large-cap for ~50% returns in a year when mid and small-caps can do the same in a month. Well, I have three things to tell my investors about that:

- At current valuations of small and mid-cap, if one has already made money over the last year then the best strategy is to book some profits and shift the funds to large caps as recommended above

- Getting into small and mid-caps now carries the risk of being stuck with a parcel for a few years. Moreover, it can only be a strategy of frequent trading and will not produce much returns, not to mention the hassle and taxes

- All the stocks above belong to NIFTY 50, so why not just invest in NIFTY 50 ETF? Well, the above stocks are in the Value Area according to my exclusive “Lucknow Bulls Technical Value Investing” system. This implies that by investing in the above list, you are essentially investing in a Smart Beta fund, which has low volatility, is in a value area, and will produce extra alpha over NIFTY 50 in the same investment period

I would appreciate it if you would carefully consider my proposed method. If you want to talk more about it, please send me an email at info@lucknowbulls.com